Inclusive Finance

TOPIn addition to actively responding to the FSC's (Financial Supervisory Commission) inclusive financial policy, Bank SinoPac also follows the policy of SinoPac Holdings regarding the response to the UN's sustainable development goals (SDGs) by formulating two major action plans, namely "Improve accessibility of financial services" and "Support the growth of small and medium enterprises (SMEs)." The Company provides more convenient and tailor-made financial services for SMEs and financially disadvantaged groups. It also enables individuals and corporate clients with different backgrounds to obtain suitable financial services on the basis of openness, equality, and diversity, thus realizing the vision of financial inclusion.

| SinoPac Holdings Inclusive Finance Policy |

Advance financial literacy and knowledge dissemination

In response to the financial education promotion goals contained in the FSC's indicators for the measurement of financial inclusion, Bank SinoPac actively holds different activities for students, migrant workers, elderly people, people with disabilities and their families, individuals in rural or hard-to-reach areas, and anyone who wants to enhance their financial management knowledge, to promote their financial literacy. During the activities, we provide tailored content to their needs in an easily understandable way, in the hope of advocating relevant financial knowledge or providing financial advice.

Additionally, Bank SinoPac actively supports the development of micro, small and medium enterprises (MSMEs) to provide diverse loan services for SMEs in Taiwan that meet their business models. In 2024, we created the "DA BOSS ecosystem platform" that provides four major services for e-commerce, including operations, management, growth, and expansion. It provides entrepreneurs with integrated solutions to help domestic medium and small enterprises and startups move towards digital transition.

Accessible Financial Services

To provide financial services to disadvantaged groups, Bank SinoPac actively implements the principle of treating customers. The branches have set up financially friendly service counters and installed locator points (tactile paving) in front of service bells at branches and flashing warning lights in accessible toilets. Automated service areas feature accessible machines. The voice-activated ATMs at branches are equipped with a visual impairment sensor function, and wheelchair-accessible ATMs have also been introduced. At the same time, we promoted the understanding of relevant functions by the disadvantaged groups through physical interactive activities to minimize the digital gap. The Company also actively invites disadvantaged groups to have real experiences. Additionally, in 2013, Bank SinoPac's MMA Financial Trading Network launched an accessible website (accessibility.sinopac.com), which was renamed "MMA Financial Friendly Network" in 2022. In 2023, it was upgraded to receive the "AA Level Web Accessibility Certification" from the National Communications Commission, providing phone voice balance inquiry and transfer services. The mobile banking app, DAWHO, and DACARD Apps offer full functionality with friendly support and have passed certification by App testing organizations.

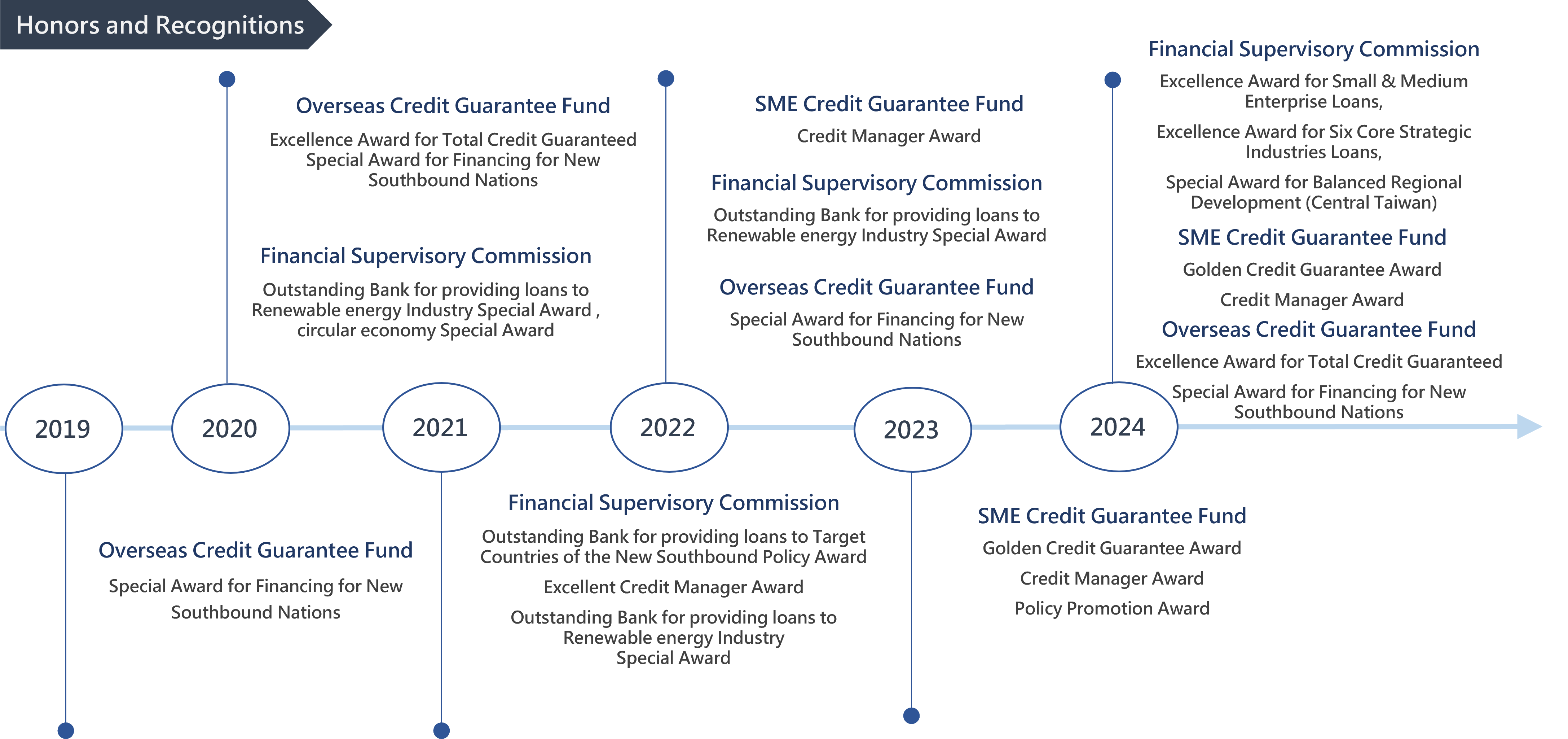

Small and Medium Enterprise Loans

Bank SinoPac provide diverse products to meet the needs of our SME enterprises. We offering a comprehensive range of financial services for different business, including financing planning, corporate trust, wealth management, cash management and business inherit. The Bank also provide the Global eBanking platform on which real-time inquiries ,transactions and corporate payroll. Moreover, Bank SinoPac also actively makes full use of guarantees provided by the "SME Credit Guarantee Fund" to provide financial products and services to small and medium businesses in accordance with the government's various economic stimulus policies. That provide SME enterprises comprehensive financing solutions to meet their expansion and transformation.

In compliance with government policies, Bank SinoPac is dedicated to fostering innovative industries, promoting economic development, and enhancing national competitiveness. To support the growth of Taiwan's industries, we provide comprehensive financial services for the six core strategic industries: Information and Digital Industries, Outstanding Cybersecurity Industries, Taiwan Precision Health Industries, National Defense and Strategic Industries, Green Electricity and Renewable Energy Industries, and Strategic Stockpile Industries.

In alignment with government policies, Bank SinoPac focus on core strategic industries and provide various financing services to meet the funding needs of enterprises at different development stages. Adhering to the spirit of inclusive finance, Bank SinoPac achieved a total SME loan outstanding of NT$400.3 billion by the end of 2024, assisting SME enterprises to expand their business and becoming their trusted partner.

Cultural & Creative Industries Lending Program /Loans for Startup and Young Entrepreneurs

To support high-quality and potential cultural and creative industries in Taiwan, Bank SinoPac provides financial service for different stages of cultural and creative businesses, including film, television and digital content industries. Bank SinoPac provide Cultural and Creative industries integrates financial products. We also help creative industries obtain the necessary funding to promote creative industry upgrades, improve the structure of the industries, and facilitate corporate sustainable development. Moreover, we pursue profits and maintain equality at the same time, so as to achieve the vision of “Fulfillment of Beautiful Life Through Finance”.

In addition, in order to assist young entrepreneurs and promote economic development together, Bank SinoPac launched the "Loans for Startups and Young Entrepreneurs", aiming to provide funding for a startup company or a person in charge or a contributor of the business entity as defined in the "Directions of Loans for Startups and Young Entrepreneurs" issued by the SME Administration of the Ministry of Economic Affairs. Bank SinoPac has assisted over hundred youth to reduce their financial burden, and we'll make youth to fulfill their entrepreneurial dreams with its core financial business.

-

Customers Service:All branches of Bank SinoPac

Migrant Worker Products

-

Migrant Worker Personal Loan

In Taiwan, basic financial services such as deposit accounts, ATM cards, digital banks, and payment instruments can be easily obtained, regardless of each individual's identity, social and economic status, and financial conditions. However, some ethnic groups, possibly due to their lack of credit records, face difficulties in borrowing from banks. Therefore, Bank SinoPac launched the "Migrant Worker Personal Loan" in 2013 to provide loans for foreign nationals using their payroll accounts at Bank SinoPac in order to help them bridge the difficulty in borrowing from banks. Bank SinoPac expanded the eligible customer group of the "Migrant Worker Personal Loan" at the end of 2018 to allow applications from individuals who have no payroll accounts at Bank SinoPac. As of the end of December 2024, more than 18,000 migrant workers benefited from the "Migrant Worker Personal Loan."

-

Credit Card for Migrant Worker by SinoPac - First-ever in Taiwan

Implementation of Inclusive Finance; Committed to the Financial Services for Migrant Worker

Bank SinoPac has been committed to the vision of “a flexible and health brand, achieving wonderful life via finance, and providing holistic solutions to our customers.” Now, we are marching towards the “sustainable development goals (SDGs)”. Currently, there are about 670,000 migrant worker in Taiwan. With a maximum stay of 14 years, Taiwan has become their second home. However, they are underserved in regard to financial products and services. With the non-cash policy actively promoted by the Financial Supervision Commission, the non-cash payment has grown to 40%. To enable these migrant worker who used to pay with cash to enjoy more convenient and safer payment methods while solving their daily payment difficulties and eliminating the service fees charged by agents, Bank SinoPac launched “SEA Rewards MasterCard” - the first-ever credit card tailor-made for migrant worker in Taiwan, in mid-October 2020. Other than cashback for general credit card spending, the card also provides rewards at certain channels and serve the function of transportation ticket Bank SinoPac also provides card-loan services at the same time. These would connect the financial ecosystem in migrant workers’ lives and increase the accessibility of financial services. On the foundation of SDGs, Bank SinoPac eliminates the unequal financial services and reverses the inferior payment options for the underserved migrant workers in the past. This is Bank SinoPac's implementation of inclusive finance, as well as social responsibility of sustainable development.

-

further details:

Credit Card for Migrant Worker by SinoPac

Smart Wholesale Market Transaction Facilitation Platform

Adhere to the concept of "Taking from society and giving back to society", Bank SinoPac has actively established the "Smart Wholesale Market Transaction Facilitation Platform" since 2015, hope to build a new model of digital transactions of agricultural products with the financial industry. Using the "Internet"、"Internet of Things"、"Big Data" and "Cloud Technologies" to introduce smart financing which not only simplify existing accounting procedures but also use information technology to streamline the production and sales process, and to improve the efficiency of manpower utilization and promote the transformation of market operation models.

With the assistance of Bank SinoPac, New Taipei City Fruit & Vegetable Marketing Co., Ltd., became the first wholesale market to adopt the "Smart Wholesale Market Transaction Facilitation Platform" in 2016. Since then we have integrated FinTech into ecology of four types of wholesale markets including fruits and vegetables, fish, meats and flowers in Taiwan. Bank SinoPac had assisted eight wholesale markets launching the Platform. The "Smart Wholesale Market Transaction Facilitation Platform" provide quality financial services to the elderly and merchants who rarely deal with banks. It has successfully integrated FinTech into the ecosphere of the wholesale market and promoted inclusive finance.

Except for merchants of the wholesale market, Bank SinoPac also expand the financial servcices to upstream suppliers and downstream retailers. The Agroecology Promotion Credit Card had launched to provide advanced payments in the supplier`s ecosystem. In addition, we have promoted payment by scanning codes in the retail markets to assist the retail payment transformation.

Bank SinoPac had made good use of FinTech to strengthen services for disadvantaged, effectively improve financial services accessibility. The spirit of altruism have gained a reputation and won many awards:

-In 2018, Bank SinoPac participated in the Ninth Taiwan Banking and Finance Best Practice Awards for Innovative Eco-Financial Services – New Type of Digital Trading in Agricultural Commodities and was honored with the Best Digital Finance Award.

-In 2019, Bank SinoPac had won the ESG Award-Social Responsibility Highly Commended Initiative of The Assets for the Smart Wholesale Market Transaction Facilitation Platform.

-In 2019, Bank SinoPac became the PwC CSR Impact Awards Gold Winner for Late night pulsation of Taipei Fishery Marketing Corp.,

-In 2020, Bank SinoPac participated in the Tenth Asia Responsible Enterprise Awards(AREA) for Smart Wholesale Market Transaction Facilitation Platform and was honored with the Social Responsibility Award.

-In 2021, Bank SinoPac participated in the Global Views Monthly CSR Outstanding Solution Awards for Fintech Transforms Traditional Agricultural Wholesale Market and was honored with the Social Innovation Group Model Award.

-In 2021, Bank SinoPac had won the 2021 Taiwan Sustainability Action Awards SDG1 No Poverty Silver Award.

-

Customers Service:Tel:+886-2-2505-9999

【New Taipei City Sanchong Agricultural Products Marketing Co., Ltd.,】We sent employees in the early morning to introduce the usage of Automatic Deposit Machine.

【New Taipei City Sanchong Agricultural Products Marketing Co., Ltd.,】We sent employees in the early morning to introduce the usage of Automatic Deposit Machine.

【Taipei Fishery Marketing Corp.,- Retail Market】We promote payment by scanning codes in the most traditional field.

【Taipei Fishery Marketing Corp.,- Retail Market】We promote payment by scanning codes in the most traditional field.

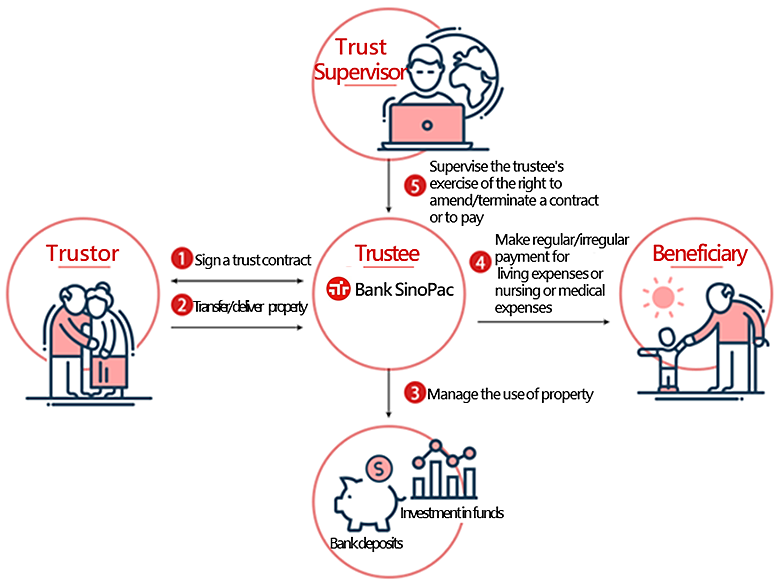

Trust for Elderly Care

Taiwan officially became an aged society in 2018 and is estimated to be a super-aged society by 2025. In response to demands for financial services from the aging population in Taiwan and the property trust policies for the elderly and the disabled, along with the Trust 2.0 - "The Promotion Plan for Full Functions of Trust Services," implemented by the Financial Supervisory Commission, Bank SinoPac launched "Trust for Elderly Care," which combines care and medical benefits, in 2016 to protect clients' properties, ensure the security of funds, and facilitate care for beneficiaries.

Trust for Elderly Care Bank SinoPac offers has the following features:

-

Protecting assets: Trust property is secure and independent and is averted from covetousness or embezzlement.

-

Using funds for special purposes: The trustee pays the beneficiary living expenses or nursing or medical expenses by contract or instructions.

-

Making independent plans: The trustor can use trust property in an appropriate and efficient manner.

-

Assigning a trust supervisor: A relative, friend, professional or social welfare organization is designated as a trust supervisor to ensure that trust-related affairs are executed in the beneficiary's interest.

-

further details:please contact the Trust Division at Bank SinoPac

Tel:+886-2-2517-3336 or Customer Service Hotline:+886-2-2505-9999.

【Trust for Elderly Care Structure】

Feng Yun Mortgage and Feng Shi Personal Loan

Feng Yun Mortgage

Bank SinoPac launched "Feng Yun Mortgage," a digital mortgage platform, in June 2017 to make loans to home buyers, borrowers, and investors in various stages of their lives. "Feng Yun Mortgage" opens up unprecedented possibilities in the banking industry in Taiwan, providing a combination of innovative services (e.g., Flexible Mortgage Payment, Online Refinance, and Immediate Mortgage Estimate) based on customers' individual criteria.

-

Online Refinance: It allows users to apply for refinancing and sign contracts online with Bank 3.0, an immediate loan assessment, and get funding in no time.

-

Flexible Mortgage Payment: Users can apply online to pay more or less on their mortgages, making their homes a flexible asset.

-

Immediate Mortgage Estimate: Users only need to enter the relevant information to get the estimated loan amount, greatly increasing the accessibility of financial services.

The number of views on "Feng Yun Mortgage" has reached 1 million since its launch. In 2018, it was selected by The Asian Banker as the "Mortgage and Home Loan Product of the Year" and also won several awards, including the "Fintech Award in ITmonth Top 100 Innovative Products" and the "14th Golden Torch Award of the Outstanding Enterprise Manager Association."

-

Visit "Feng Yun Mortgage"

Personal Loan

Bank SinoPac continues to drive digital innovation, aiming to simplify the loan application process and enhance customer experience. Initiatives include: (1) integrating with the MyData platform from the Ministry of Digital Affairs, enabling customers to quickly obtain financial information online during loan applications, significantly shortening the review process; (2) piloting a financial income estimation model, allowing customers who cannot provide physical income certificates to easily apply for loans. By creating a digitally innovative loan service model, customers can complete applications in just a few simple steps, eliminating cumbersome procedures and quickly accessing funds, making financial services available anytime, anywhere!

iPiggy Bank

Bank SinoPac has long observations that customers often have to deposit incomes in different accounts for separate management of their living expenses, travel expenses or investments. It is time-consuming and labor-intensive to manage multiple accounts. In order to make saving money easy, fun, and painless for customers, Bank SinoPac launched "iPiggy Bank" in September 2020, which is the so-called "JARS system." With Mobile APP, customers can use and manage their funds in multiple jars.

For every primary account at Bank SinoPac, customers can open a "Change Jar" and choose to deposit the daily balance of NT$100 or NT$1,000 or less on their demand deposit account in the "Change Jar." It is just like collecting small money every day, making it easy to build wealth and be happy.

A "Dream Jar" is also an option for customers with various dreams. By setting goals (e.g., travel and buying a house) and depositing money periodically, customers will end up accumulating a sum of money that helps make their dreams come true.

To help customers realize their dreams quickly, money can also be transferred to time deposits or used to invest in other wealth management products. This allows customers to build wealth fast and manage return on investment more easily. If there is a temporary need for funds, the savings in "Change Jar" and "Dream Jar" can be withdrawn flexibly.

-

further details:iPiggy Bank

|

Micro Products

In response to the spirit of inclusive finance, Bank SinoPac also strives to lower the threshold of financial services by designing various micro products and services for new graduates, people with mediocre incomes, and economically disadvantaged groups.

|

Micro Products |

Primary Scope of Service |

|

Micro lending |

|

|

Micro deposits |

|

|

Micro funds |

Bank SinoPac launches a 100-dollar fund that can be purchased with a minimum amount of 100 dollars, and set up a product-specific description page on the website in order to reduce the investment threshold to help the petty bourgeoisie community to facilitate wealth management. It includes fixed-term investment (amount not fixed) in multiple currencies including NTD, USD and RMB, which can be purchased with the minimum subscription amounts of NT$100, US$100 and RMB100, respectively. |

|

Small amount insurance |

In response to the aging society, Bank SinoPac cooperates with external partners and provides “Fubon Life Jinlaibao Small Amount Whole Life Insurance”. |

-

Customers Service:All branches of Bank SinoPac