Sustainable Finance

TOPAs an institutional investor, Bank SinoPac is responsible for fulfilling stewardship and enhancing the value of investment with its expertise and influence. To achieve responsible investment, Bank SinoPac takes into account environmental, social, and governance (ESG) issues in the long-term interests of customers and shareholders. On June 8, 2018, Bank SinoPac signed the compliance statement on the "Stewardship Principles for Institutional Investors." In order to urge investee companies to take environmental protection, corporate social responsibility, and corporate governance seriously, Bank SinoPac created its own "Guidelines for Responsible Investment in December 2019 in compliance with the “Guidelines for Responsible Investment” formulated by SinoPac Holdings in June of the same year. As the guiding principles for investment and asset management at Bank SinoPac, the "Guidelines for Responsible Investment" applies to asset management and consulting services covering public equity, fixed income, private equity, infrastructure, property, and derivatives. In addition to incorporating ESG issues and risks into the decision-making process for main business activities, Bank SinoPac has drawn up methods and tools for assessing ESG risks, as well as related regulations, to facilitate the implementation of responsible investment.

In August 2020, Taiwan Stock Exchange Corporation released the revision of the "Stewardship Principles for Institutional Investors." Bank SinoPac updated its compliance statement accordingly on September 16 of the same year. Bank SinoPac has also formulated the "Stewardship Policy." In addition to continuing to monitor the operations of investee companies, Bank SinoPac participates in corporate governance of investee companies by attending their shareholders' meetings, exercising voting rights, and engaging in dialogue and interaction with their directors or management appropriately in order to promote their sustainable development and to protect the overall interests of Bank SinoPac's fund providers.

For Bank SinoPac's "Stewardship Principles for Institutional Investors" and "Stewardship Policy," visit the Corporate Governance session on the company website:Stewardship Principles.

Bank SinoPac understands the financial industry plays an important role in reducing global carbon emission, as it controls the majority of the cash flows supporting the economy. By following the Equator Principles and incorporating ESG factors into its risk assessment process, Bank SinoPac pays close attention to clients' understanding towards the risks and opportunities brought by climate change as well as its influence on financial performance, in order to take proactive countermeasures further.

-

Policy and Management of Corporate Banking

Bank SinoPac established the “Responsible Lending Management Guidelines” and incorporate ESG considerations in the lending process. If ESG risk factor exists, the business unit shall engage with customers to explore the situation and assist customers to improve and respond by evaluating and proposing mitigative and remedial measures. In the event that customers involving in serious issues or cannot resolve issues continuing for a long time, the Bank should evaluate the business relationship in a prudent manner. Review process and engagement includes:- Prohibit lending to controversial industries: e.g. pornography, controversial arms.

- Carefully Evaluate Sensitive Industries: enhanced ESG risk analysis on sensitive industries, including oil and gas, coal-fired power generation, gambling, those with issues in food safety, toxic radioactive substance, non-medical and hazardous genetic engineering, non-adhesive asbestos fiber and polychlorinated biphenyls (PCBs) manufacturing.

- Follow the business restrictions imposed by the Decarbonization Policy of SinoPac Holdings. (please refer to the official website of SinoPac Holdings)

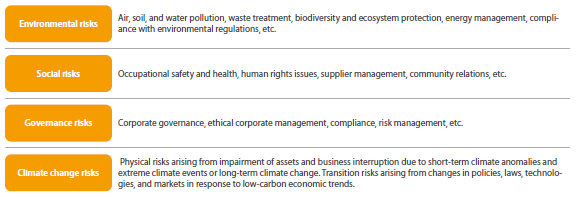

- Incorporate ESG related factors, such as environmental, social, governance, and climate change risks etc., into the lending processes:

- Communicate and collaborate with clients in industries with high climate risks (including industries with high carbon emissions) and advise them to provide data on GHG emission intensity and low carbon transition strategies, and invest in green loans.

- Encourage clients to engage in socially responsible lending for reducing inequality, providing basic life necessities, or providing suitable work to create positive relationships, and avoid and resolve negative impact on stakeholders. The Company encourage them to make positive contributions to social goals without harming the environment.

- Focus on whether clients assess and respond appropriately to the risks and opportunities of climate change and natural capital, whether they understand the impact of climate change and loss of biodiversity (including conservation of species, and habitat preservation) on their financial performance, and whether they have taken response measures.

- Actively direct funds to sustainable economic activities and encourage clients to adopt the "Taiwan Sustainable Taxonomy", fill out the "Corporate Self-Assessment Questionnaire of ESG Information", and plan carbon reduction or transition investment project.

-

Equator Principles

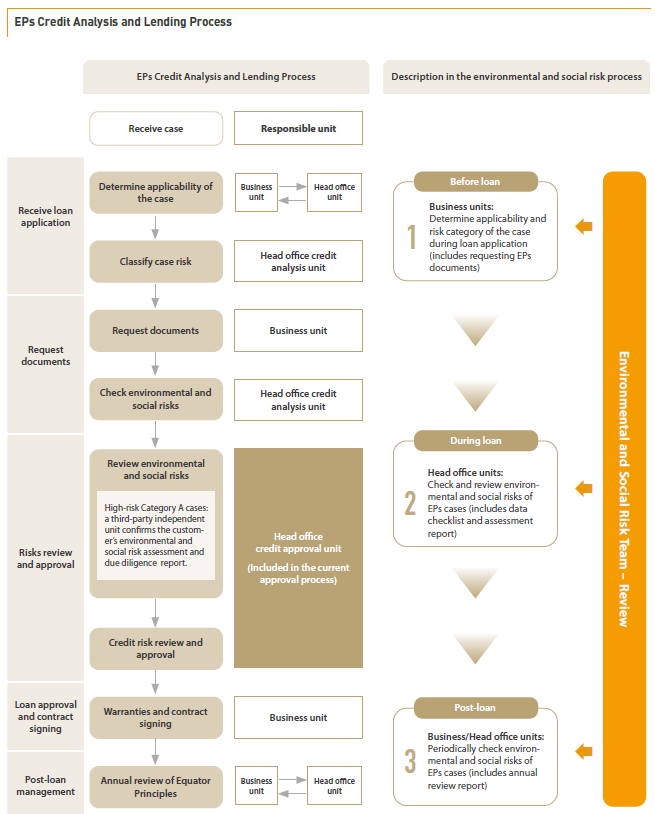

Bank SinoPac formally became a signatory to the Equator Principles (EPs) in February 2020. SinoPac established EPs related guidelines and operating procedures, completed EPs training sessions, strengthening the management of human rights risks and climate change risks in the credit investigation and lending process for project financing. It also complies with EP4 and the eight Performance Standards of International Finance Corporation (IFC) and included climate change and biodiversity risks as necessary items.

Bank Sinopac established a dedicated Environmental and Social Risk Team in November 2021, serving as an internal consultant for the risk assessment and review of EPs cases. For high-risk cases, the team seeks assistance from a third-party external consultant according to the EPs. The Company has also incorporated Equator Principles cases into the self-inspection items starting from December 2022 and a third party from head office will inspect the process of Equator Principles cases regularly.

Solar Energy Equipment Financing Project

-

Financing for Corporate Solar Energy Plants

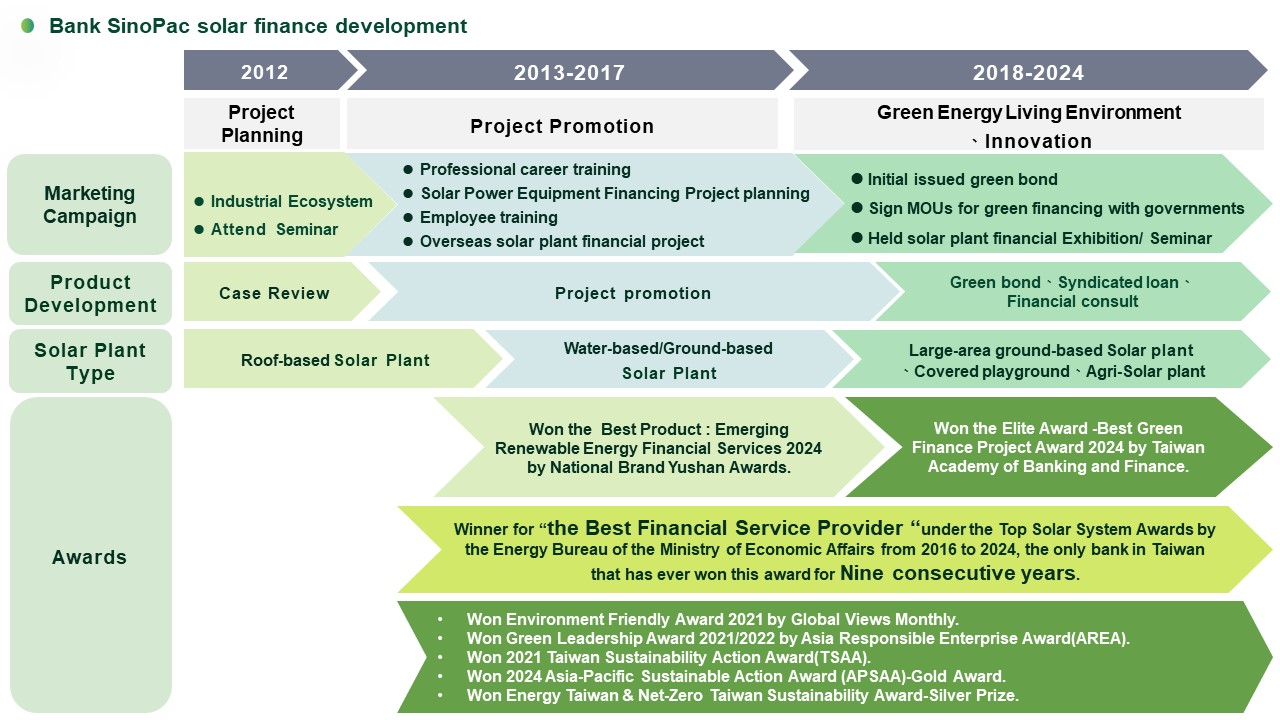

To satisfy the needs of both individuals and corporate customers, Bank SinoPac launch “Solar Energy Equipment Financing Project” in 2013. Based on the construction schedule of Solar Energy plants, Bank SinoPac provided loans to customers at all stages of the project. We provide financial solution for ecosystem's upstream and standard financing project for ecosystem's downstream to establish a complete and professional portfolio of financial services for the green industry chain.Bank SinoPac has firstly involved in the short-term financing (bridge loans) for the solar energy plants during the construction period, which makes companies more willing to invest. In addition to the development of various green financing products, Bank SinoPac also initial issued green bond to connect among green finance and energy-saving build equipment. Moreover, Bank SinoPac promote the first green energy trading and assistant enterprises integration into energy 100% renewable electricity.

-

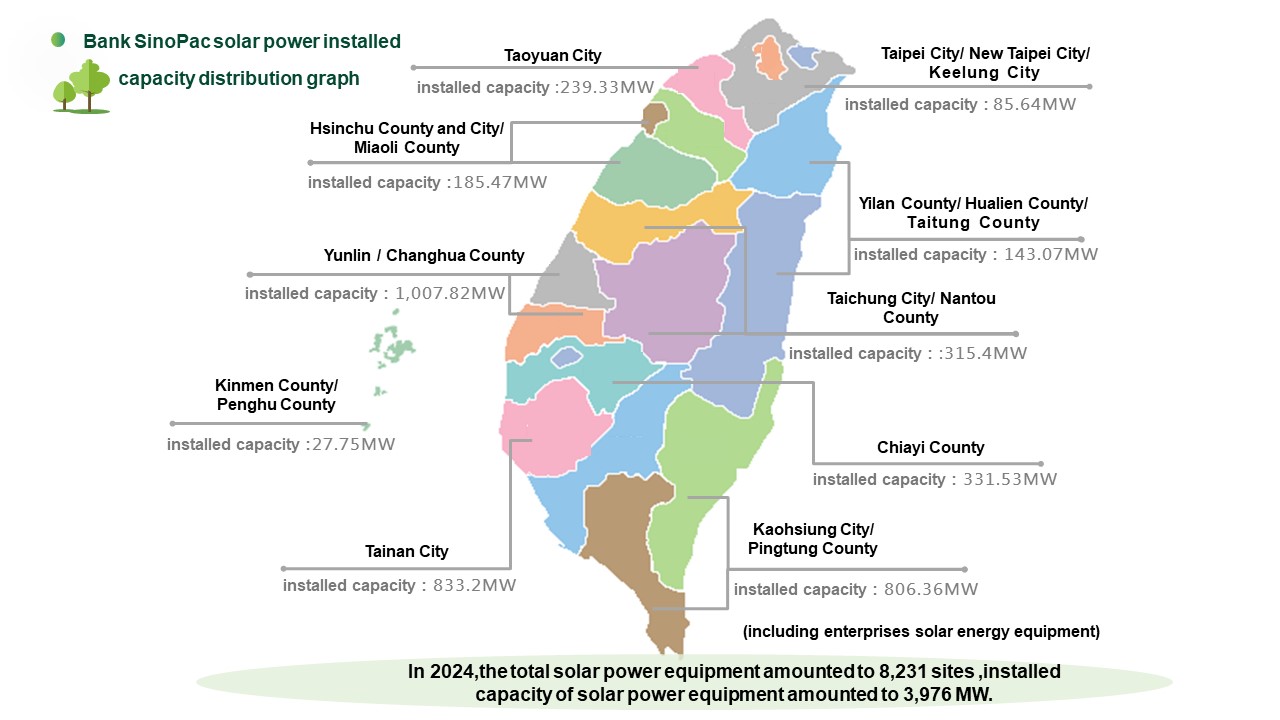

Promoting Green Energy Living Environment

Bank SinoPac focuses on "Energy Generation (Solar Energy Plant), Energy Storage, Energy Saving and Green Finance" to create a green energy living environment. We provide timely and appropriate financing options for companies to assist the construction, operations and maintenance of solar energy plants, including roof-based, ground-based and water-based energy plants.We also sign MOUs for green financing with local governments and become the first international exhibitor in financial industry.As of the end of 2024, the total loan outstanding amount for solar power generation equipment of domestic enterprises was approximately NT$128.2 billion. We'll make renewable energy market, new client and new products to provide Solar Energy Financing Projects that evolves with time.

-

Customers Service:All branches of Bank SinoPac

-

-

Loans for financing household solar energy equipment

Individuals and households have started the investment of solar photovoltaic equipment to fulfill their commitment to renewable energy and reduce daily expense. Bank SinoPac responded to the needs of personal customers/households with a quick loan approval process granting a loan amount up to 90% of the appraisal value of the solar energy equipment with a tenure up to 15 years. This has helped significantly reduce the barriers for the installation and increase individuals' or households' willingness to invest in the installment of solar energy equipment on their own rooftops.-

Customers Service:All branches of Bank SinoPac

-

Sustainability-Linked Corporate Loans

-

Purpose: With the intensification of global extreme climate change impacts, sustainable development has become a crucial goal for the current global economic transformation. Bank SinoPac is committed to deeply rooting sustainable finance. Through the promotion of this project, Bank SinoPac aims to guide clients in implementing corporate social responsibility, enhancing the importance of sustainability-related issues such as Environmental, Social, and Corporate Governance (ESG). It is expected that both the companies and Bank SinoPac can jointly achieve mutual benefits of sustainable development.

-

Applicable Targets: Domestic publicly listed companies or overseas companies without negative ESG information and not engaged in controversial industry activities.

-

Project Content: Bank SinoPac clients who meet the above applicable targets and achieve relevant sustainable development assessment indicators can enjoy a preferential interest rate reduction mechanism for loan approvals.

-

Business Consultation: Please contact the business locations of each branch.

-

Others: For any matters not covered, please follow the relevant regulations of the competent authorities and Bank SinoPac.

Eco-Friendly Textile Industries

After the "Paris Agreement" formally came into effect in November 2016, important supply chains in the global economy rushed to grasp business opportunities in the "Green Economy" trend. Renowned international sports brands issued green declarations successively, which were targeted by Taiwanese companies as the green business opportunities. Bluesign is the most comprehensive environmental protection standard used in the global textile industry. Textile companies applying for the Bluesign certification are required to invest more than NT$100 million in wastewater treatment equipment, and incur additional expenses on raw material procurement and personnel training. Therefore, Bank SinoPac provides financing to domestic textile companies who plan to obtain the Bluesign certification in order to assist their transition into a green textile company.

-

Customers Service:All branches of Bank SinoPac.

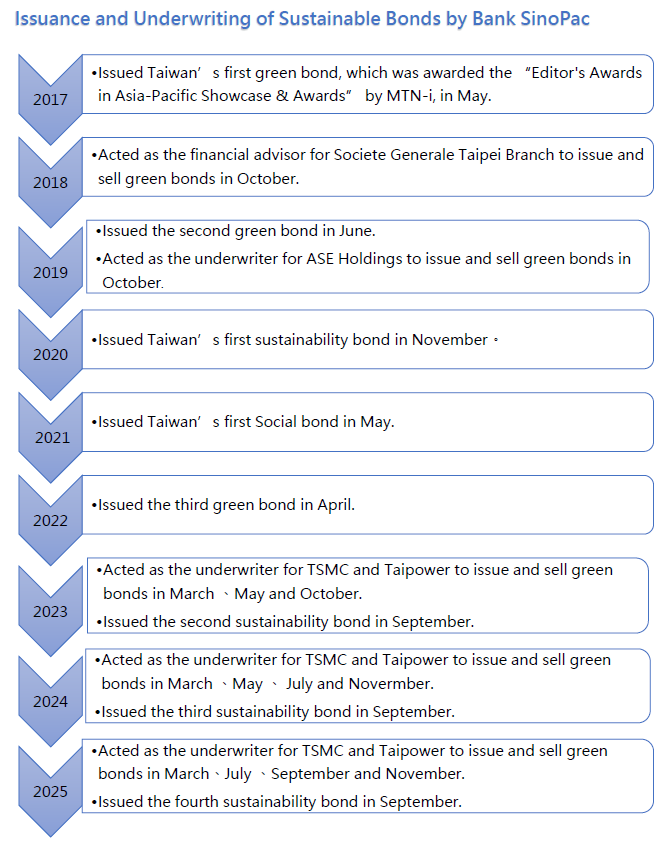

Issuance, Guidance, and Underwriting of Sustainable Bonds

Taipei Exchange (TPEx) promulgated the "Taipei Operation Directions for Sustainable Bonds" to assist enterprises raise funds, promote sustainable environmental development, and establish a mechanism for TPEx trading of sustainable bonds in Taiwan.

In order to respond to the government policy and to fulfill corporate social responsibility, Bank SinoPac issued a green bond worth US$45 million in May 2017. This green bond initiative was awarded the "Editor's Awards in Asia-Pacific Showcase & Awards" by MTN-i, an internationally renowned platform providing bond market coverage, in recognition of Bank SinoPac's leadership in Taiwan's green bond market. In 2019, Bank SinoPac issued another green bond worth NT$3 billion.

In addition, Bank SinoPac acted as the financial advisor/underwriter for Societe Generale Taipei Branch and ASE Holdings and assisted them in issuing and selling green bonds.

According to the "Green Finance Action Plan 2.0" initiated by the regulatory authority, Bank SinoPac once again took the lead in issuing Taiwan's first Sustainability bond worth NT$1 billion in November 2020 to fulfill corporate social responsibility. The funds raised will be used for the development of renewable energy and energy technology, creating jobs and programs that can reduce or avoid unemployment caused by the socio-economic crisis.

Bank SinoPac issued the first social bond in Taiwan in May 2021 with a total amount of NT$1 billion, accounting for 9.1% of total bond issued in 2021. Funds raised from social bonds will be used for five types of social responsibility investment plans, and this batch focuses on providing project financing for "Affordable Housing," "Employment generation, and programs designed to prevent and/or alleviate unemployment stemming from socioeconomic crises," and "Socioeconomic advancement and empowerment."

Bank SinoPac issued the third Green bond in April 2022 with a total amount of NT$2 billion, all funds raised will be used for investing that is renewable energy and energy technology development.

Bank SinoPac issued the second Sustainability bond in September 2023 with a total amount of NT$2 billion, all funds raised will be used for lending that is consistent with green and social benefits.

Bank SinoPac issued the third sustainability bond in September 2024 with a total amount of NT$1 billion, all funds raised will be used for lending that is consistent with green and social benefits.

Bank SinoPac issued the fourth sustainability bond in September 2025 with a total amount of NT$1 billion, all funds raised will be used for lending that is consistent with green and social benefits.

As of today, Bank SinoPac has issued sustainable bonds approximately NT$12.4billion.

-

Contact us for bond issuance:T70000-GP15@sinopac.com

Green Insurance

Bank SinoPac continuously supports the green transformation of photovoltaic industry players and actively assists renewable energy companies by offering insurance products that cover potential risks arising during their operations.

We provide comprehensive protection solutions to help our clients obtain full coverage as they expand their businesses.

-

Customers Service:All branches of Bank SinoPac.

Green Deposit

What is "Green Deposit"?

Green Deposit refers to the funds that Bank SinoPac will use for green projects complying with the Green Bond Principles published by the International Capital Market Association (ICMA), or being recognized by Joint Credit Information Center (JCIC) as " Green Loan " or financing/refinancing projects that align with Bank SinoPac's Green Loan Principles.

Green Deposit project

Bank SinoPac will use customers’ deposits for green projects complying with the Green Bond Principles published by the International Capital Market Association (ICMA), or being recognized by Joint Credit Information Center (JCIC) as " Green Loan " or financing/refinancing projects that align with Bank SinoPac's Green Loan Principles. Through the issuance of sustainable financial products such as Green Deposit, Bank SinoPac aims to promote the sustainable development goals and fulfill the Corporate Social Responsibility. This project will annually be evaluated or assessed by independent third-party assurance institutes. Related assessment or assurance reports on the status of allocation of the funds will be publicly disclosed on Bank SinoPac's website.

Use of Funds

The use of funds for Green Deposit will be allocated to broad categories of the above-mentioned eligible green projects, including but not limited to Development of renewable energy and energy technology, Pollution prevention and control, Improvement of energy efficiency and energy conservation projects.

Bank SinoPac issued The Green Deposit project from March 2024 to February 2025 ,raising a total of NT$2.72 billion, all proceeds will be allocated towards loans aligned with substantial benefit for improving the environment.

Green Mortgage

-

Having attached importance to environmental sustainability and climate change issues, Bank SinoPac is actively promoting a series of actions to mitigate climate change. Hence, Bank SinoPac has launched the "Green Mortgage" in support of sustainable building designs for the purpose of protecting the environment and saving the Earth.

Green buildings are buildings that cover four areas - "ecology, energy saving, waste reduction, and health (EEWH)." Communities that are awarded the Green Building Label must obtain approval from the Taiwan Architecture & Building Center (TABC) and meet nine indicators - greenery, soil water content, water resource, energy conservation, carbon dioxide emission, waste reduction, sewer and garbage, biodiversity, and indoor environment. With an emphasis on integration with the environment and ecology, green buildings pursue sustainable development through effective use of building resources as well as co-existence and co-prosperity with the environment through their life cycle.

Bank SinoPac cordially invites you to build a sustainable home and co-create a wonderful and eco-friendly life. In the future, Bank SinoPac will continue to offer innovative financial services that move with the times and develop new markets, new customers. and new products for renewable energy.

-

Customers Service:All branches of Bank SinoPac.

-

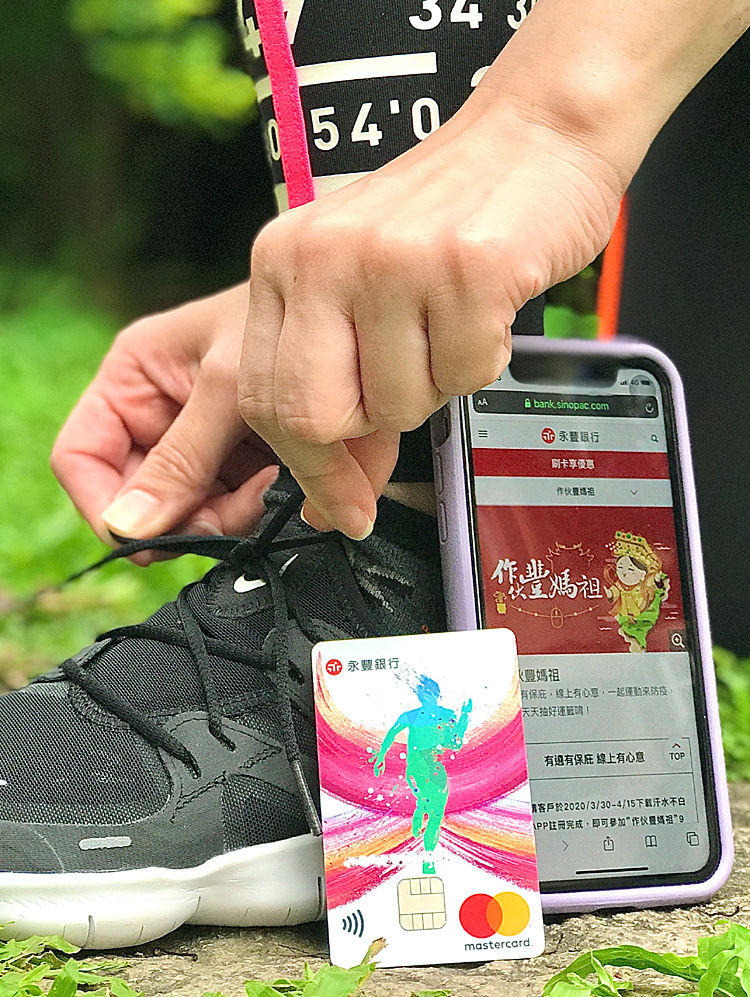

SinoPac SPORT CARD

-

Connect the sports and health ecosystem via IoT

As well-being has gained awareness globally, Bank SinoPac (“SinoPac”) pioneers the integration of sports, consumption, and financial services by connecting the sport and health ecosystem via the IoT. It encourages consumers to earn their cashback through exercise, thereby “achieving your wellbeing while accumulating your wealth.”

SinoPac SPORT Card is the first credit card earning cashback through calorie burning in Taiwan. SinoPac further launched the “Fun Sport App” for consumers to record their burnt calories every day. By using IoT technology, this app integrates big data, social communities, cloud calculations, and wearable devices to translate these cardholders' burnt calories into bonus points. Also, consumers may team up via the app to encourage each other to emphasize health and do exercise, while deepening the interactions over the social communities. SinoPac's expectation is to engage more consumers while integrating the core financial business to provide a new “inclusive finance” environment where consumers achieve their well-being through exercise.

-

Cross-Industry Collaborations for the Brand New Sports and Health Ecosystem

SinoPac SPORT Card manifests sports and health. SinoPac enhances collaboration with other industries in the ecosystem, e.g. exercise and fitness operators, sports goods channels, organic food, drugstores, and pharmacies, to provide well-rounded health services to consumers and optimize the IoT sports ecosystem. In addition, it also integrates financial IoT technologies with religious belief. It invites everyone to group-up for “Offertory to Mazu,” whether staying at home, going to work, or exercising and having fun. Teams that achieve 0.5 million steps are qualified for lucky drawings for the offertory to Mazu contributed by SinoPac.

-

Innovative IoT Ecosystem is Well Recognized.

SinoPac SPORT Card and Fun Sport App are well recognized.-

Received the Bronze Award as the Best Product Innovation by Digital Times in 2019.

-

2020

- Named the Best IoT Initiative by the international financial media, The Asian Banker; the first Asia Pacific financial institution awarded since the award began.

- Named the Best Initiative in Innovation for the Asset ESG Corporate Awards 2020 by the international financial magazine, The Asset.

-Named the Health Promotion for the Asia Responsible Enterprise Awards 2020.

-

-

Outcomes

As of December 2023, the accumulative data is as follow:Total calories (cal) Total steps (step) CO2 emission (kg) 17.1 billion 570.7 billion 81 million Note:1 step= 0.03 calorie; to reduce one kg, 7,700 kcal need to be burnt; 10,000 steps= 1.42 kg of CO2 emission

-

further details:

Bank SinoPac's Official Site for SPORT Card

Team up via Fun Sport App

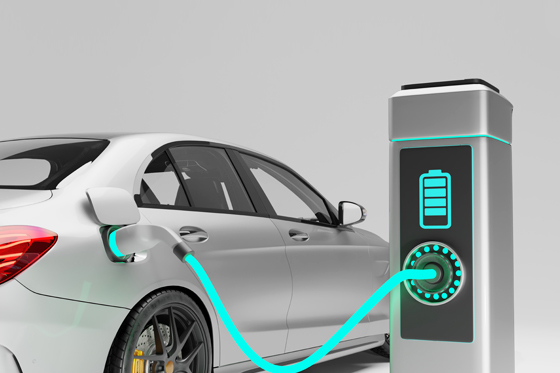

Electric Vehicle Financing

-

Apply for loan and enjoy up to NT$3,000 off on handling fees.

Electric vehicles feature characteristics such as clean, eco-friendly, safe, and durability …… etc., making them the main force of future green transportation. In response to the government’s “Air Pollution Prevention Action Plan” and to support domestic clean energy, Bank SinoPac encourages the public to purchase low-carbon electric cars and motorcycles. We offer EV owners a special car loan program with a maximum handling fee discount of NT$3,000, up to 84 installments, and preferential loan conditions starting from zero handling fee. Join us to save fuel, reduce carbon emissions, and contribute to preventing global warming.

- Business Consulting : Leave a message online to contact us. Our digital specialists will reach out to you within 1 hour during business hours.

- Important Notes

- Annual Percentage Rate (APR) Example : Loan amount: NT$300,000, term: 5 years, annual interest rate: floating rate 2.50%~14.60%, total related fees: NT$0~6,000, APR: 2.50%~15.53%. The APR is not equal to the loan interest rate. The calculation base date for this APR is June 23, 2025.

- Floating Rate Calculation : I + 0.79%~12.89%, where “I” refers to Bank SinoPac’s personal finance loan index rate (monthly adjustment), based on the lower of the average one-year fixed deposit rate of the top ten banks and Bank SinoPac’s one-year fixed deposit posted rate. Currently, “I” is 1.71%, with the calculation base date of June 23, 2025.

- The APR disclosed in this advertisement is calculated based on the standard example filed with the competent authority. Actual loan conditions are subject to the products provided by the bank. Each customer’s actual APR may vary depending on their individual loan product and credit conditions.

- Repayment Method : Monthly equal principal and interest payments.

- Early Repayment Penalty : [Restriction period applies to loans with terms that are 12 months or longer from the disbursement date.]

(1)If full or partial repayment is made during the restriction period, an early repayment penalty will be charged based on the prepaid principal multiplied by the penalty rate.(2)Penalty rate : Within 6 months from the disbursement date: 4% of the prepaid principal. From the 7th month to the end of the restriction period: 3% of the prepaid principal. The calculation method for the early repayment penalty is subject to the individual agreement.

- Bank SinoPac reserves the right to approve or reject loans, determine the loan amount and interest rate, and adjust product specifications, application periods, and other related regulations. Actual content is subject to the latest announcement by Bank SinoPac. The required conditions, documents, approved interest rate, and product details such as contract terms may vary depending on individual circumstances.

Sales Agent of ESG Funds

By selecting overseas/domestic green/ESG concept funds under "Friendly Earth" category, Bank SinoPac provide customers more choices to help customers incorporate sustainability concept into investment portfolio.

-

Please refer to our website for overseas/domestic green/ESG concept funds:further details